|

Managing the New COBRA Subsidy under the American Rescue Plan Act of 2021

The American Rescue Plan Act of 2021 (ARPA), signed by President Biden on March 11, 2021, includes a number of provisions designed to assist workers impacted by the COVID-19 pandemic.

Among them is a new COBRA premium subsidy that pays for 100% of the applicable COBRA premium for eligible individuals with respect to coverage periods beginning April 1, 2021, and ending Sept. 30, 2021. In order to comply with the law, employers will face a number of challenges and additional administrative responsibilities including the identification of premium subsidy-eligible individuals, contacting previously terminated employees not currently enrolled in COBRA but who are eligible for the premium subsidy, revising or supplementing existing COBRA notices, and satisfying new notice requirements.

This lunch and learn webinar, hosted by Central NY SHRM and Bond, Schoeneck, and King will provide attendees with information regarding how to successfully abide by the updated COBRA subsidy requirements, as well as answer the following questions:

- What plans are required to comply with the premium subsidy requirements?

- Are individuals who previously declined COBRA coverage or discontinued COBRA coverage potentially eligible for the subsidy?

- Who is entitled to the premium subsidy?

- What notice requirements apply for individuals who become entitled to elect COBRA between April 1, 2021, and Sept. 30, 2021?

- What notice requirements apply for individuals who became entitled to elect COBRA before April 1, 2021, and to individuals entitled to a second election period?

- What other new notices does ARPA require?

- How are employers and plans reimbursed for the premium subsidy amount?

March 29, 2021

Program: Noon - 1 pm

Location: Zoom

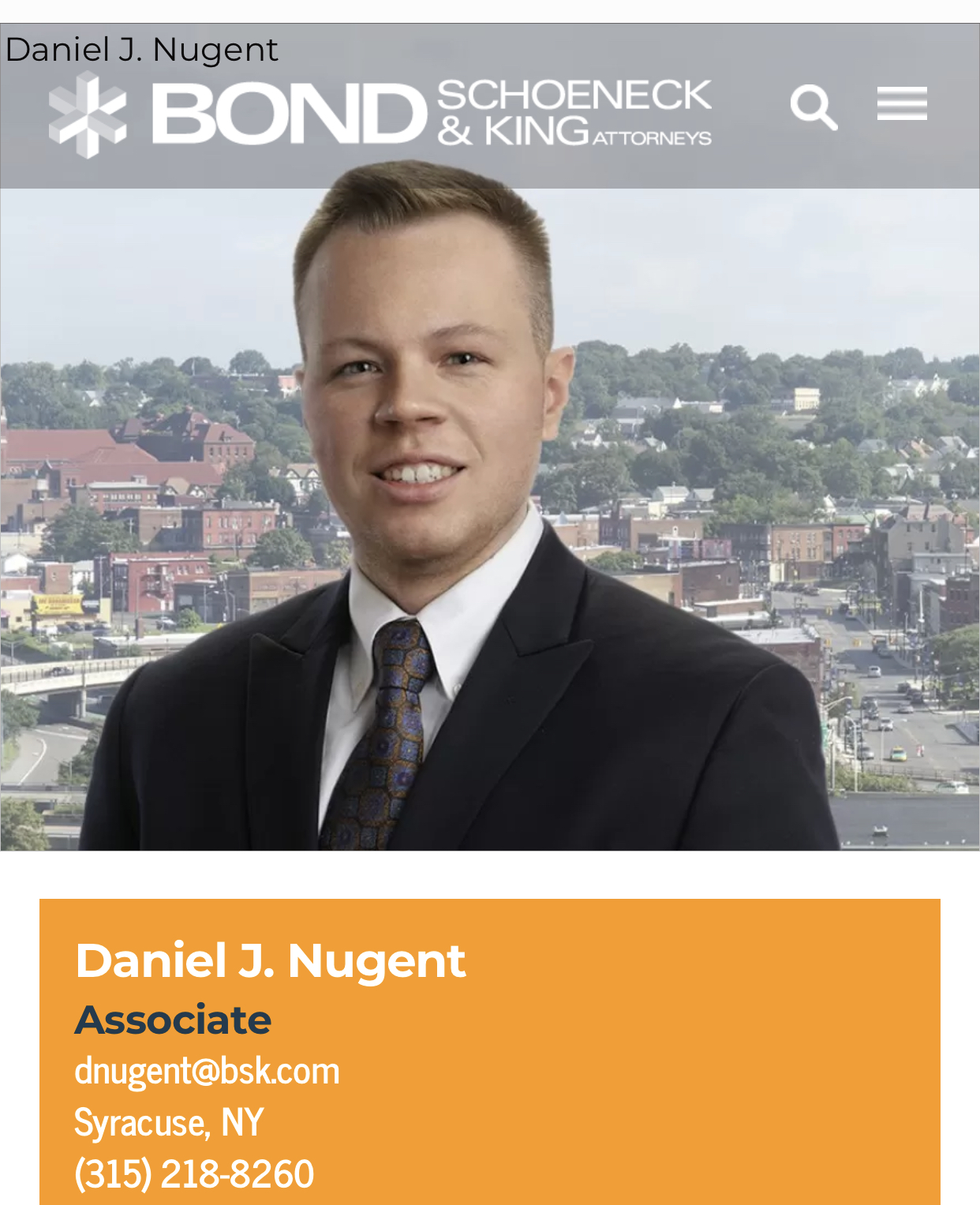

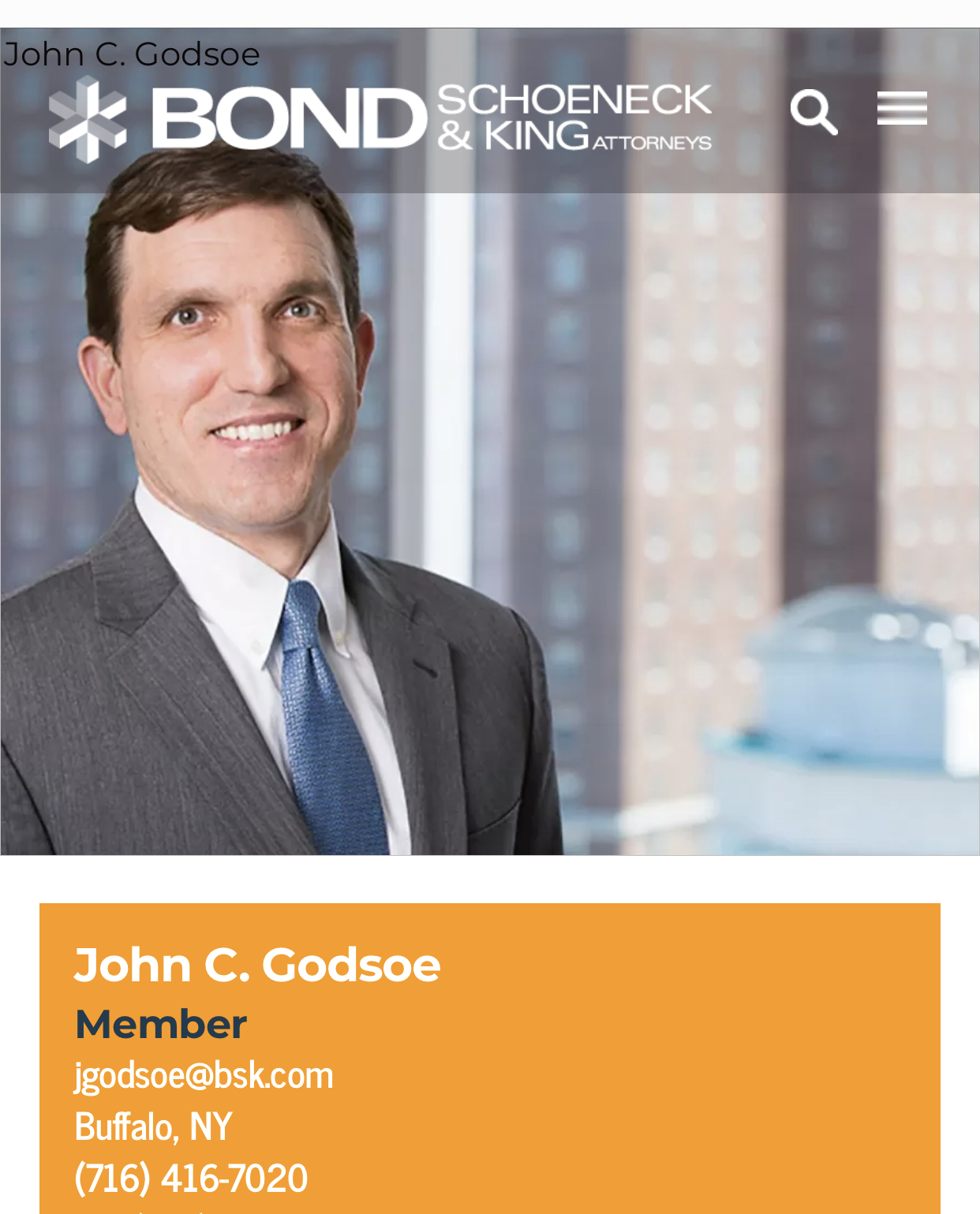

About Our Presenters: Daniel (DJ) Nugent & John Godsoe

Daniel counsels his clients on a wide range of employee benefits and executive compensation matters for both public and private sector clients. He assists clients with the correction of retirement and health and welfare plan errors including the filings of Voluntary Correction Program and Voluntary Fiduciary Correction Program Applications. Daniel also counsels clients on ERISA litigation and governmental investigations.

Daniel’s experience includes:

-

Drafting employment agreements and separation agreements involving considerations of IRS Sections 409A and 457(f)

-

Designing, drafting, implementing, amending, terminating, and aiding in the operation and compliance of ERISA and non-ERISA plans, including:

-

Retirement plans;

-

Non-qualified deferred compensation arrangements;

-

Health and welfare plans which encompass aiding in the compliance with the requirements imposed by the Affordable Care Act and COBRA; and

-

Educational Assistance Program plan documents

John is an employee benefits attorney who understands the needs of employers in this complex area of the law. He focuses on providing practical legal advice that helps clients achieve their goals in the most cost-efficient manner possible.

John works with a wide range of employers, including public and private employers, non-profit organizations and higher education institutions. As benefits counsel, he works collaboratively with human resource professionals, finance managers, and retirement plan committee members to provide timely, sensible, and prudent solutions to their benefit problems.

John’s experience with retirement plans includes:

- Counseling retirement plan committee members regarding ERISA fiduciary obligations

- Assisting plan sponsors with IRS and DOL audits

- Achieving cost-saving results for plan sponsors under IRS and DOL correction programs

- Advising clients with respect to the design, implementation, and termination of qualified retirement plans, including 401(k) plans, profit-sharing, and defined benefit plans

- Tax-sheltered annuity (403(b)) plans

- Executive compensation and non-qualified deferred compensation plans

John’s experience with welfare benefit plans includes:

- Affordable Care Act (ACA) compliance, including compliance with the employer, shared responsibility requirements of the ACA

- Self-insured medical plans

- Defined contribution health arrangements, including health savings accounts (“HSAs”); health reimbursement arrangements (“HRAs”); and health flexible spending accounts (“Health FSAs”).

- COBRA compliance

- HIPAA compliance

- Cafeteria plans

This program is pending approval for 2 Professional Development Credits (PDCs)

through HRCI

Pricing:

Member = $25

Non-Member = $35

|